for anyone following Curve and understands its unnecessarily complicated accounting model (which, because of the ve model, is probably fewer than 5 people in the world) - how's it looking for them?

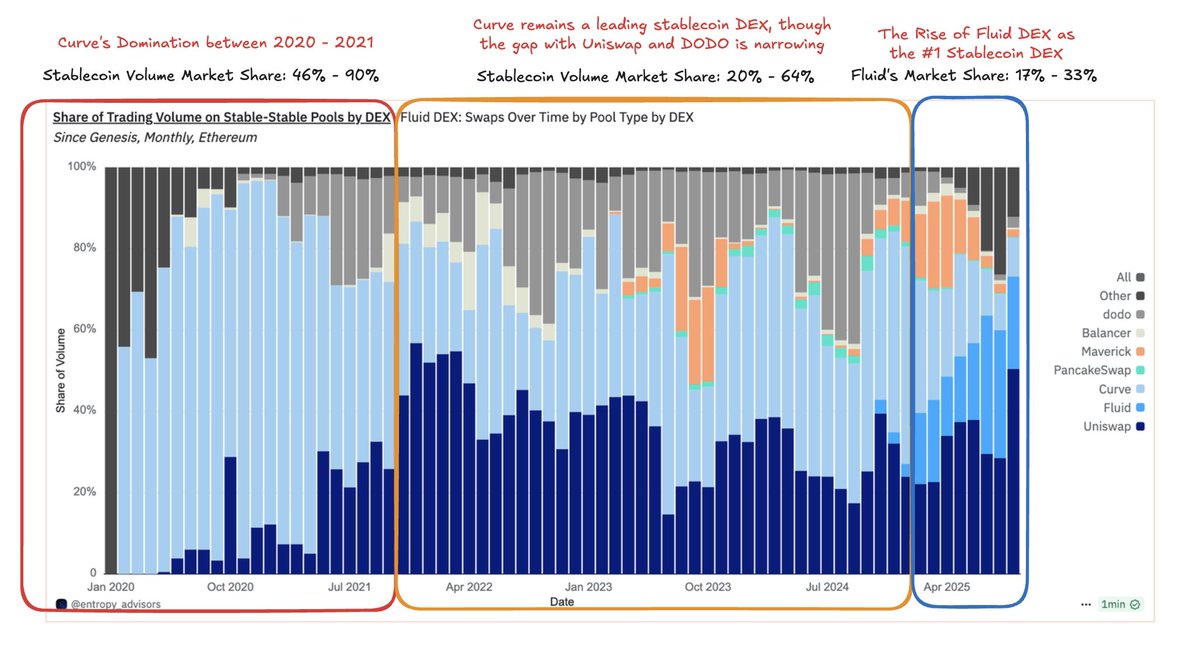

From Curve to Fluid, the shift in the primary liquidity hub for Stablecoins on Ethereum.

Curve's Dominance from 2020 to 2024:

During the DeFi summer, Curve built the deepest stablecoin liquidity on mainnet with its 3pool. At its peak, 3pool had $6B in DAI/USDT/USDC liquidity, making Curve the key venue to monitor potential liquidity risk for stablecoins. With its deep liquidity, Curve dominates stablecoin-to-stablecoin volume on mainnet, capturing over 40% market share.

The Rise of Fluid DEX:

Stablecoin projects are establishing their main liquidity hub on @0xfluid DEX in this cycle, including GHO, USDe, wstUSR, RLP, and sUSDe. With its smart collateral and Smart Debt, I see a way for Liquidity Providers and Market Makers to be more willing to supply liquidity on Fluid DEX, as they can potentially earn higher fees from lending and trading, and access liquidity by borrowing from the smart positions.

Currently, Fluid finds its strongest niche in Stablecoins. 90% percent of its volume comes from stablecoin-to-stablecoin swaps. It has also become the primary liquidity hub for:

- USDe: 55% of total DEX liquidity

- wstUSR: over 90% of total DEX liquidity

- GHO: 67% of total DEX liquidity

In August, Fluid was the top DEX for stablecoin-to-stablecoin swaps, accounting for 31% of the volume, while Curve ranked second after Uniswap with a 9.6% market share.

While it is now the 2nd consecutive month for Fluid to lead in this category, we need to still be cautious whether Fluid's dominance can sustain. In the past, Dodo/Maverick also overtook Curve's crown briefly, but the key here is to see whether Fluid can remain dominant in this area for 6+ months.

27.74K

100

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.