In this THREAD I will explain “Order book”

1. Order book Heatmap

2. What is an Order book?

🧵(1/12)

1. Order book Heatmap

When is it bearish?

• Large sell clusters = limit asks

• Stacked sell walls overhead persist, repeatedly reject price

• Sell walls step down toward market (sellers chase lower prices)

• Bid-side below thin (“air pockets”) so dips accelerate

1.1 Order book Heatmap

When is it bullish?

• Large buy clusters = limit bids

• Stacked buy walls below absorb sells and hold levels

• Buy walls step up toward price (buyers chase higher → higher lows)

• Ask-side above is thin, so small buy flow lifts price quickly

1.2 Order book Heatmap

What is unique about Kiyotaka Heatmaps is that they show hyperliquid liquidation prices

Which are actual liquidation prices guaranteed to happen on-chain

1.3 Order book Heatmap

Kiyotaka’s Heatmap shows a grid where each block's intensity reveals how many buy or sell orders exist at different price levels during each time period.

Stronger intensity means more orders

1.4 Order book Heatmap

The Heatmap Magnifier gives you a closer look at specific areas of the heatmap without zooming in the chart.

When you pause your cursor over any area, the magnifier appears, showing the exact liquidity values at that position and its surrounding blocks.

1.5 Order book Heatmap:

Order book + Heatmap strategy

When the SCF Orderbook shows strong green (buyers) and the heatmap has short-liquidation clusters above price, expect a short squeeze.

Strong red and long-liquidation clusters below price increase risk of a cascade lower.

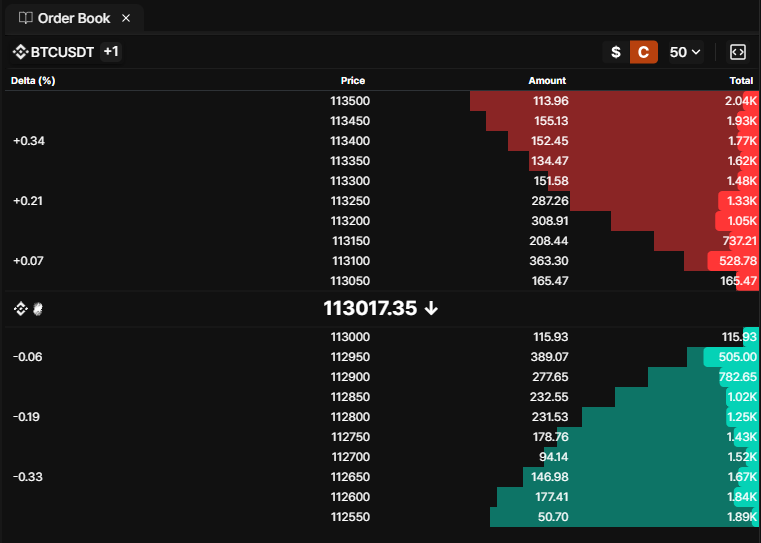

2. What is an Order book?

The Order book shows the available liquidity (volume of coins/tokens) at every price level.

Heatmaps transform this information into a visual format that's much easier to interpret than raw numbers.

2.1 What is an Order book?

Bids: Buy orders below current price

Asks: Sell orders above current price

Amount: Volume available at that exact price level, what can be filled there immediately

Total: Showing cumulative depth and where support or resistance may form

2.2 What is an Order book?

Order book Depth Indicator

Provides a streamlined view of market imbalances as layered areas on your chart:

- Spot significant imbalances

- Track depth changes over time

- Identify potential support/resistance zones

2.3 What is an Order book?

Limit Orders: Orders placed at specific prices that wait to be filled

Market Orders: Orders that execute immediately at the best available price

The Order book: The complete collection of all limit orders waiting to be filled

This Thread was a brief exposition of what I posted in my PDF.

I've posted the PDF and my indicators in Kiyotaka here:

I'm using @Kiyotaka_ai for Liquidation Heatmaps and Orderbook

23.85K

329

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.