Since the beginning of 2024, Pendle's TVL exploded from ~$230m TVL to a peak of $13b TVL during September.

With a 500% TVL growth and ascension to top 10 DeFi protocols by TVL, there's MULTIPLE factors that fit together to make things work.

Intern's thought? Stablecoins.

👇

Stablecoins are one of the largest growing DeFi verticals, more than doubling in size since 2024 to $300b.

With entries from @BlackRock and @FTI_US, its a highly valued innovation frontier from some well-known institutional players.

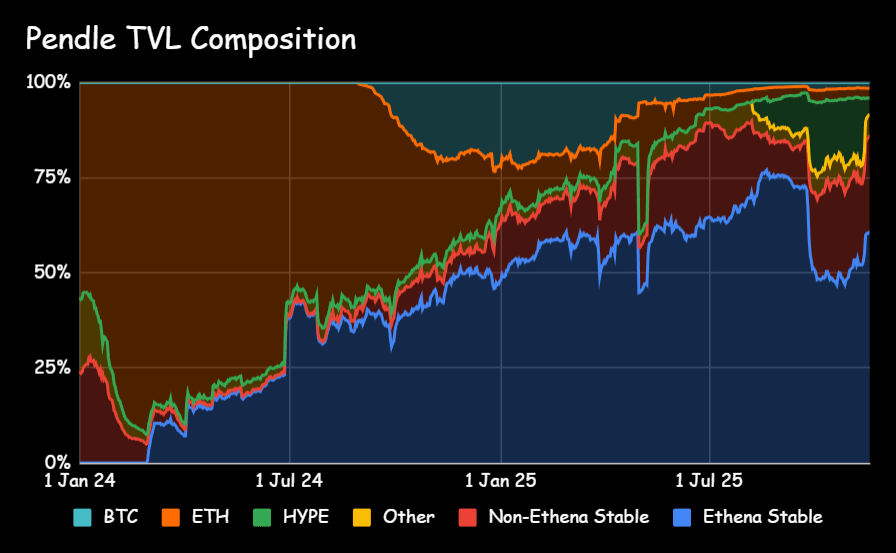

With the expansion of stablecoins on chain, its interesting to observe Pendle's TVL composition has seen a similar evolution.

Why, we hear you ask?

Our product suite naturally morphs with market supply/demand. As more stables enter the market, more stables enter Pendle.

Our highest impact integration is arguably @ethena_labs whose USDe-related pools contributed $9.3b TVL at its peak.

With over $4b PT supply put to use as collateral on money markets, Pendle x Ethena PTs are a critical component for much of DeFi today.

In the same timespan, non-USDe-related stablecoin TVL has also grown immensely, from $60m initially to a peak of $1.6b.

With diversification across multiple key pools, this component of TVL is largely insulated from large maturity events.

As new narratives are born and DeFi continues to evolve, Pendle v2 will evolve alongside it.

The reality is we're in EARLY STAGES for DeFi innovation and there's no telling what the next narrative will be.

There's only positioning yourself to catch it when it comes.

Pendle

6.29K

51

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.