.@0xfluid DEX V2 launches this month, here’s everything you need to know before it flips every other DEX in a few weeks.

Fluid DEX V1 launched just a year ago, focused purely on correlated pairs, USDT/USDC, wBTC/cbBTC, ETH/wstETH, and so on.

Fluid DEX sources liquidity directly from the lending layer. When you borrow against collateral, that position is simultaneously used to facilitate trading and generate extra fees, meaning part of your borrow interest is literally paid by traders.

This setup worked flawlessly for correlated assets. Fluid DEX did over $155B in volume in its first year, generated $25M in annual fees, and contributed ~20% of total Fluid treasury revenue.

It quickly captured 35% of market share on Ethereum, with only a few of correlated pairs. So imagine what will happen when volatile pairs go live?

Today, it accounts for 53.3% of all USDC-USDT Ethereum trades.

79% of all GHO-USDC trades

89% of all sUSDe-USDT trades.

I can go on and on but you get the drill by now. Fluid has become the second-largest DEX on Ethereum by volume and the third across all chains, again, just by focusing on correlated pairs. Its market share in those pairs hasn’t stopped climbing since launch.

Other DEXs like Uniswap or Curve have to constantly incentivize LPs with high APYs to keep liquidity. Fluid doesn’t. Capital is already there, deposited and borrowed against, and the trading fees are pure bonus yield. That lets Fluid offer the lowest fees and beat competitors.

This creates a flywheel:

Better yields + best borrowing conditions → more deposits → more liquidity → more trading volume → higher market share -> Higher yields -> repeat

Since DEX V1 launch, Fluid Lending’s TVL grew from $700M to $5.5B across EVM and Solana (via @jup_lend), a ~700% increase.

And that’s while focusing ONLY on correlated pairs.

V2 launches this month, opening the doors to volatile pairs (concentrated liquidity, custom price ranges, dynamic fees, etc).

Fluid is on track to become the #1 DEX by Q1-2026 across all of DeFi, on every major chain.

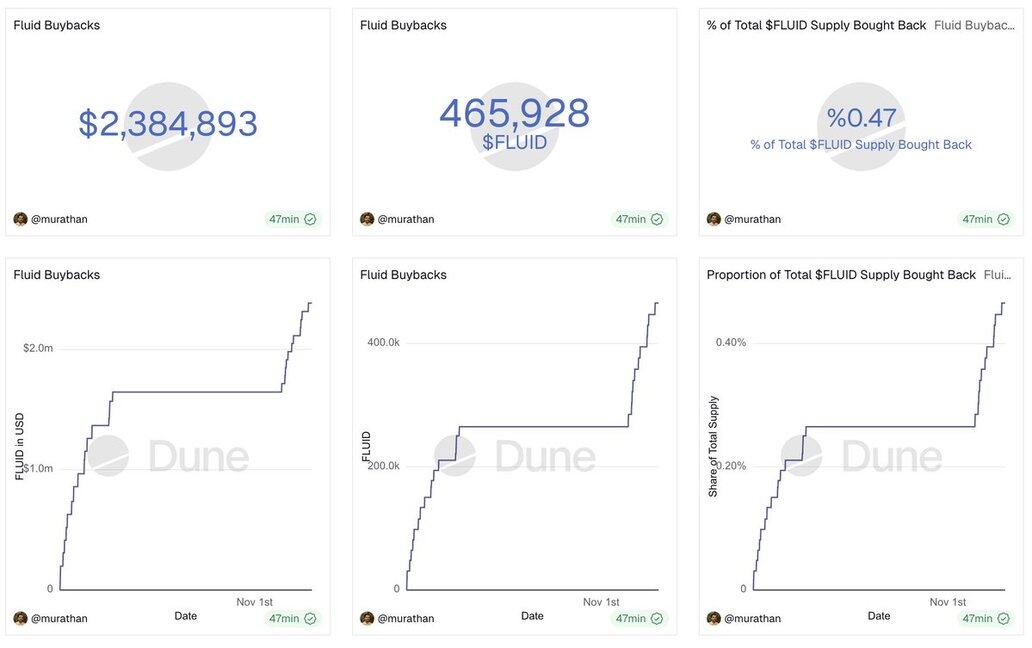

Oh, and all that revenue is used for buybacks, which I expect to at least double in a year.

@0xfluid 0.47% of total supply is bought back in just ~40 days of revenue buybacks. This does not include revenue from @jup_lend yet.

6,679

42

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。